Get me through December

Get me through December

A promise I’ll remember

Just get me through December

So I can start again~ from the song “Get Me Through December”

Markets and economics, like life, move in cycles. The only sure thing about a very long up or down-swing is that it will inevitably reverse. December is a time when neither markets, economics or our lives may necessarily be at the peak or bottom of their cycles, but the end of the calendar year still makes us reflect on where we stand on all three.

The holiday season only adds to that effect. We (hopefully) have some time to see friends and family we may not see throughout the rest of the year, and take some time to stop and reflect on the year that was and the year yet to come. December finds many of us a little weary from the events of the preceding 11 months (and perhaps from Christmas preparations and socializing).

Some of us look forward to this time of year, not only as a chance to catch up with family and friends but to catch our breath and get a fresh start in the New Year. If you’ve had a rough year, you can take a look at whether you had any control over that outcome, and plan to hit the restart button. If you’ve had a great year, you can look at ways to do more of what’s working and store away some reserves for the coming year.

Kondratieff winter

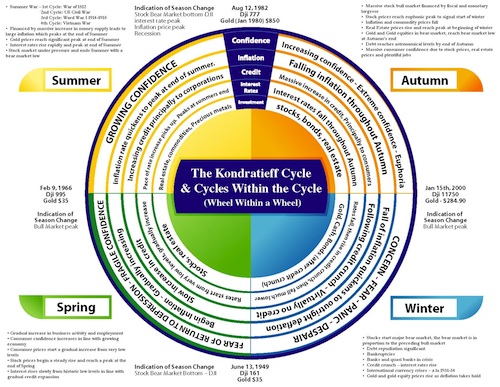

I’m not sure if you’ve ever heard of Nikolai Kondratieff, but he is known for coming up with a very long term theory on economic cycles. December is a great time to look at the BIG picture. We’re talking generations, not years here. An updated model of the theory, proposed by Ian Gordan of Long Wave Group, proposes a cycle of four seasons. Here’s a quick summary of the characteristics of each season:

Spring

- Follows a “winter” season that includes a depression

- Gradual increase in business activity, interest rates, employment, and consumer confidence from very low levels

- Stock prices begin a slow rise and reach a peak at the end of spring

Summer

- Massive increase in money supply leads to a burst of inflation that peaks near the end of summer

- Gold and interest rates rise rapidly and peak at the end of summer

- Stock market under pressure and ends summer with a bear market low

Autumn

- Massive stock bull market financed by fiscal and monetary stimulus

- Euphoric peak in stock prices signals beginning of winter

- Inflation and commodities prices fall

- Real estate peak at the beginning of winter

- Gold in bear market, but lows hit as winter begins

- Debt reaches astronomical levels by end of autumn

- Soaring consumer confidence due to elevated real estate and stock prices, and plentiful jobs

Winter

- Stocks begin major bear market

- Debt becomes a dirty word

- Banking crisis

- Credit crunch – interest rates rise

- International currency crises

- Gold rises as deflation takes hold

This information and much more can be found in this chart:

(Click on the chart for a really big version)

The whole 4-season cycle lasts 50 – 70 years and we are currently in the 4th full cycle since the early 19th century. As you can see, we are currently experiencing winter. At first glance, that might seem a little depressing. But guess what? Once we’re through winter, we get to start again.

Your life cycle vs. the Kondratieff ycle

This longer cycle dynamic brings home the point that where you are in your life cycle compared to the larger economic cycle matters. If you put most of your money to work in the summer and autumn and you just happened to enter retirement as the first winter blast hit, you probably wouldn’t fare very well. This is not hypothetical. A good number of people are actually in that leaky boat right now.

On the other hand, if you’re in your 20s now, you may be entering a really great period of time to be a long term investor. You will likely be entering your prime investing years during spring. The key will be to recognize when the leaves start to change and make the appropriate adjustments. 😉

Using December wisely

This reflective holiday season is the perfect time to take a look at some of these big picture issues. Take some quality time to assess and reassess your goals, and set a course for the New Year. It’s healthy for your portfolio, for your wallet and for your peace of mind.

With all of that said, I’d like to wish each of you a very Merry Christmas and all the best for the New Year. I’m taking some time off to stop and reflect, but I’ll be back in January with some fresh perspective for you. In the meantime, I wish you peace during this holiday season and I hope the coming year brings you prosperity – whatever that means to you.

Do you find yourself feeling a little more reflective as the year draws to a close?

Comments

I have even more encouraging news to report than your highly encouraging report that Spring is on its way, Two Cents. I believe that the next Spring will be a permanent Spring.

I agree 100 percent that it is important to understand the concept of Stock Cycles. Those who don’t get it that stock prices move in cycles don’t understand how stock investing works (I of course mean no offense to anyone with these words).

The problem with Stock Cycles is that they have grown too large. As our wealth has expanded, higher and higher percentages of the population have invested in stocks. We are in a situation today where the Summer cycle caused such insane levels of overvaluation that it is going to take something extraordinary (the power of the internet!) to keep us from going over a cliff in this Winter cycle. We can never, ever, ever again permit a Summer cycle like the one we just lived through.

I believe that we are today on the threshold of the biggest advance in our understanding of how stock investing works in history. We are soon going to be able to teach people about how Stock Cycles work and about how they should invest given the reality of Stock Cycles.

Guess what that means? It means no more Stock Cycles! There can never again be insane overvaluation once the majority of investors have a means of learning of the dangers of insane overvaluation. Once people learn the realities, they will lower their stock allocations at the first sign of overvaluation and the selling will bring prices back to fair value. It will be never Winter and always Christmas!

There was no electricity until some smart human discovered it. There was no British Invasion until John Lennon struck up a conversation with Paul McCartney. Cynics point out that bad stuff happens from time to time. True. They too often fail to note that wonderful stuff also happens from time to time and, like the bad stuff, often when we least expect it. The bad stuff often CAUSES the wonderful stuff because it is experiencing the bad stuff that gets us all off of our duffs and out looking about for electricity and beats you can dance to and ideas for bringing Stock Cycles to a permanent stop.

Rob

Thanks for your comments Rob. Yes, like the “real” weather, our economic climate seems to be seeing more extremes this cycle.

I’m not as confident as you are that people will learn their lesson regarding high valuations once and for all. I think it could last through another spring, summer and autumn, but human nature being what it is, we may see more stretched valuations at some point in the future – and probably another winter.

But after that it will be spring again. I would love to see more attention to valuation become permanent, but it seems there will always be folks who are looking for the quick score, no matter what the price.

Merry Christmas Rob. I hope you get to enjoy some quality time with your family. 🙂

Interesting chart… we tend to create these things to bring some sense of order (and control). Because our world does tend to “cycle,” it brings a sense of optimism and hope; yet, when we become too optimistic, we have a chart to help us see why we need caution and concern. Hmm… it sounds like a natural cycle of “balance.” Interesting, don’t you think?

I do think it’s interesting. It’s just a nice reminder that “this too shall pass.” Hope December’s been good to you Doc! 😉

I was not familiar with the seasonal analysis. However, you did an amazing job explaining it, and it all makes perfectly good sense. Thanks for sharing!

Some people think this is not much more than a ouija board for the markets, but you just have to look at history to see that it does indeed rhyme, even if it doesn’t exactly repeat.

Thanks for your comment! 🙂

Interesting cycle indeed. Just like Mother Nature, the cycle shows we humans are creatures of habit as well…sometimes bad ones at that 🙂

For sure. But thank goodness we have some good habits too! 😉

Thanks for stopping by.

@Rob That’s a lovely dream, but I think you’re grossly underestimating human stupidity.

I love to see that Spring is finally just around the corner! It’s been a rough winter for everyone, and a new cycle is very welcome — great post!

The seasons under bad monetary policy is like the Earth with an unstable axial tilt — the seasons are much more worse and downright dangerous than they otherwise would be. I hope we can head toward an eternal Spring, but it will require a rethinking of the role of central banks, fiat money, and government’s role in managing money in our lives.

Central banks essentially act like someone giving too much candy to a small kid — sure, maybe the kid was greedy, but who should you really blame?