Everything You’ve Ever Wanted to Know About How to Write a Cheque

Although cheques are not as common as they once were, you may need to write out one from time to time. But don’t complicate the process. There are a few simple things you should know to avoid any issues when writing a cheque.

What is the Purpose of a Cheque?

The purpose of a cheque is to transfer money from your account to another person, account, or company.

They are more secure than cash because only the cheque recipient will be able to deposit the money.

What Details Are Needed to Write Out a Cheque?

There are a few minor details you will need when filling out a cheque.

- Correct spelling of the recipient’s first and last name or the company name used for payments.

- Amount of the cheque

- Today’s date

Before You Write a Cheque

Before you write out a cheque, make sure that you have enough money in your account to cover the amount of it. If not, once that cheque is deposited or cashed, you could be subject to a non-sufficient fund charge from your bank and/or the recipient.

How to Write Out a Cheque in 5 Easy Steps

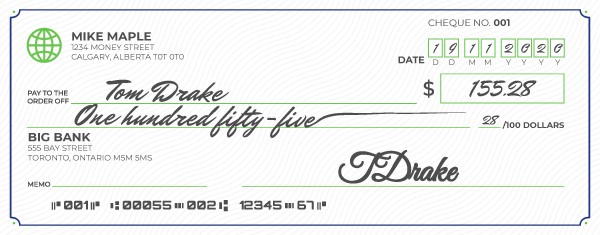

- Write today’s date in the top right-hand corner. It’s best practice always to write the date that you sign the cheque. But you can postdate your cheques by writing out a date in the future.

- Fill in the recipient information on the “Pay to the order of” line. Ensure that you have the correct spelling of the first and last name if it’s a person and the correct name used for payments if it’s a company. If you are writing out a cheque to cash, then write the word “cash.”

- Write out the amount in numbers in the box by the dollar sign on the right-hand side. If the amount includes cents, make sure to write out 2 decimal places.

- Write out the amount in words on the middle line of the cheque. If the amount includes cents, write out that part as a fraction; some cheques even have the fraction /100 already printed on the cheque. For example, if you write out a cheque for $8.59, you would write eight dollars 59/100. Then make sure to draw a horizontal line from the end of your words to the end of the printed line. This will ensure that nobody can change the amount.

- Sign the cheque in the bottom right-hand corner on the signature line. Make sure not to sign the cheque before you have filled in the recipient. And try to be consistent with your signature on every cheque that you sign.

Optional – fill out the memo line for what the cheque is for. This is also a good place to put the account or invoice number if you are paying one.

How to Write a Cheque to Yourself?

If you need to move money from one account to another and cannot do it electronically, you can write a cheque.

To do this on the “pay to the order of” line, write out your name. Fill in the cheque with all of the other required information, and then be sure to sign it.

Now you can deposit it into any of your accounts.

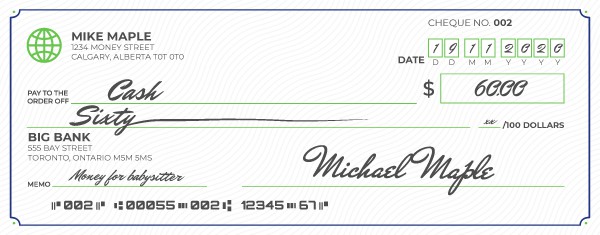

How to Write a Cheque to Cash?

Although cheques are more secure than cash, there may be a time when you need access to cash. You can withdraw money from your account by writing out a cheque to cash.

To do this, write “cash” on the “pay to the order of” line. Then fill out the rest of the cheque with all of the required information. Remember to sign the cheque to make it valid. Filling in the optional memo field with what the cash is for will help you keep track of your money.

A word of caution when writing out a cheque to cash.

Once you do write out a cheque to cash and sign it, anyone can now take it and deposit it. Make sure to keep that cheque secure until it has been converted to cash.

How to Write a Cheque With Cents?

To write out a cheque with cents, write out the amount in numerals in the box with the dollar sign. Make sure to write it out with 2 decimals.

Then on the line below the “pay to the order of” line, write out the dollar amount in words. The amount of cents doesn’t need to be written out in words. Write it out in the decimal format. For example, 28 cents would be written as 28/100.

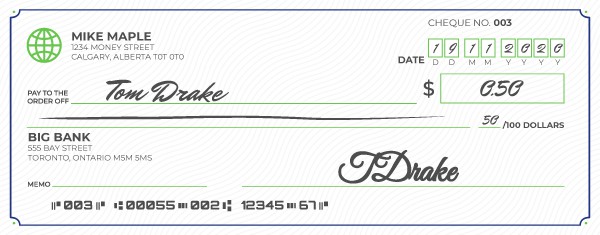

How to Write a Cheque for Less Than a Dollar?

If you are writing out a cheque for less than a dollar, then put a horizontal line through space over the line where you would normally write out the amount in words.

Write out the amount in numerals (numbers) in the box with the dollar sign. Remember to write out the amount with 2 decimals. So, if you wanted to write out a cheque for 50 cents, you would write $0.50, not ¢50.

What if I Make a Mistake When Writing a Cheque?

Mistakes happen.

If you make a mistake when writing out a cheque, cross out the mistake with a single horizontal line. Write the corrected information near the crossed-out mistake. And then initial beside the correction.

This error correction will be sufficient for most minor cheque writing mistakes.

But if you have to correct multiple mistakes, it may best to void your current cheque and write out a new one. There is a risk that the bank will not accept an overcorrected cheque.

After You Write a Cheque

Once you have written out a cheque, you will want to give it to the recipient. If you are writing out a cheque to cash, be sure to cash it right away. Protect it so that it doesn’t get lost or cashed by someone else.

It is important to keep track of all of the cheques you write. If your chequebook came with carbon copies, then keep the carbon copy. If not, then you can keep track of your cheques in a cheque register. Often you will receive a cheque register when ordering or purchasing cheques.

What Are the Benefits of Writing a Cheque?

- More secure than cash – cheques are more secure than cash because only the recipient can deposit them.

- Ability to track – you can track cheques easier than you can track cash. Once you write out a cheque, if you keep a record of it in your cheque register, you will always know what that cheque and money were for. Some banks even offer digital cheque images so that you can see what the cheque was for when you log into your online banking. Filling out the memo field with as much detail as possible will help with this.

- Easier to carry around than cash – no matter the amount on the cheque, it is always physically the same size. Cash can be big band bulky if handled in large amounts.

What Are the Drawbacks of Writing a Cheque?

- Price – although it does not cost you to write out a cheque, you will often be charged when purchasing a book of cheques. Some banks offer the first book of cheques free, but you will have to pay for more once you run out.

- Less secure than electronic banking – before the innovation and security of online banking, cheques were one of the easiest ways to transfer money. Now it is much easier and secure to send an e-transfer or make an online payment.

- Not universally accepted – although cheques were once universally accepted, this is no longer the case. Many businesses will no longer accept a personal cheque as payment – asdf – source?

What Is a Postdated Cheque?

A post-dated cheque is one that has the date written for the future. The cheque cannot be cashed or deposited until that date.

If you’re the recipient of a postdated cheque, some banks will hold onto it for you and deposit it into your account on the cheque date. And some banks will charge you for this service.

You can also store the post-dated cheque in a secure place yourself. Then just set a reminder in your phone for the date of the cheque. You will then have 6 months to cash or deposit the cheque before it becomes stale.

When Would You Need to Write a Cheque?

Although electronic payments and debit and credit cards are increasing, there are still times when writing out a cheque may be preferred.

- Giving money as a gift

When gifting money for a wedding or birthday, a cheque is more secure than cash and has the same value for the recipient. - Paying rent

Some landlords still require rent payments by cheque. They also prefer postdated cheques for the duration of the lease. This prevents them from having to chase their tenants for rent payment. - During a power outage

During a utility or power outage, electronic banking will not work. But cheques can still be accepted. - To avoid service charges.

Some businesses charge a service charge for credit card transactions. But not for cheque transactions

What Do the Numbers on a Cheque Mean?

The numbers on the bottom of the cheque are what make it unique and secure.

The first series of numbers represent the cheque number.

Next is the transit number. This number identifies your specific bank branch. Just as each banking institution has a unique number, so does each branch of those banking institutions.

To the right of the transit number is the branch or bank number. Each bank in Canada has a branch number. This helps to differentiate one bank account number from the same account number at a different bank.

And the last number represents the bank account number of the cheque. And the last number is the account number that the cheque is attached to. This is your personal chequing account number.

All of your cheques will have the same transit, branch, and account number. Only the cheque number will be different on each.

What if You Need a Cheque but Don’t Have One?

If you need a cheque but either don’t have a chequebook or have no cheques left, you can usually get one printed off at your bank free of charge.

But your bank will only provide a few cheques free of charge before you have to order and pay for a full chequebook.

How to Keep Your Cheques Secure?

Although cheques are more secure than cash, you will still want to ensure you keep them secure to avoid unnecessary charges/withdrawals from your account.

Here Are 5 Tips for Keeping Your Cheques Secure

- Do not sign the cheque until you have written out the recipient.

- Keep your blank cheques in a secure location.

- Try to avoid writing out cheques to cash.

- If the cheque is no longer valid or required, void the cheque.

- Draw a line through any unused space (this prevents someone from filling in the blanks)

Besides keeping your cheques secure, you will also want to ensure that you always keep your chequebook in a secure location at all times.