Wise Review (formerly TransferWise): A Better Way to Conduct Foreign Exchange?

The high fees and bloated exchange rates incurred when sending and receiving foreign currency can be a bitter pill to swallow. This is especially true for anyone who has to send international money transfers regularly.

Much of the problem lies in the exchange rates offered by banks, which are priced well above the actual market exchange rate. Not only that, fees on wire transfers can be as high as $50 or more, depending on the amount of money you’re sending.

Wise Money Transfers

I recently wrote an article on the various ways you can exchange money, so I thought the timing was right for a review of Wise, a leader in online foreign currency exchange previously known as TransferWise. Thankfully, companies like Wise are around to take the sting out of the foreign exchange, as well as sending money overseas.

Using the latest in mobile technology, Wise makes foreign exchange instant and affordable. In this Wise Canada review, I’ll show you exactly how Wise works to save you money and why it’s a better way to send money than through traditional channels, i.e., your local bank branch.

What Is Wise?

Wise (formerly Transferwise) is a U.K.-based company offering money transfer services. It was founded in 2010 by two friends, Kristo Käärmann and Taavet Hinrikus. Fast forward to today, Wise is now worth more than $1 billion and boasts more than 6 million customers.

According to Business Insider, “the idea for Wise surfaced when its two founders realized that they could cut down on the cost of international money transfers by paying each other’s expenses. Hinrikus used his money in Estonia to pay for Käärmann’s mortgage, and Käärmann used his money in the UK to send payment to Hinrikus. Wise avoids international bank-transfer fees by keeping the money transfers inside the country, using domestic accounts to minimize the distance that money has to travel.”

How to Save Money with Wise

Wise saves you money in three ways. For starters, all foreign exchange is conducted using mid-market exchange rate or real exchange rate. This is the rate without the spread that’s applied to bank transfers, which means you’re getting the lowest possible rate of exchange, regardless of the amount of currency.

No Hidden Fees

While Wise does charge a nominal fee to send money, it’s typically under 1%. Compare that to the 2.5% foreign exchange fee whenever you make a foreign currency purchase with your credit card. Or, the high fees charged by your bank when you send funds via wire transfer can be upwards of $100, depending on the amount you are sending. I should point out that it’s free to receive funds into your Wise account. With bank wire transfers, recipients are usually charged a fee when the funds arrive in their account.

Lastly, you will pay a fee when you make your payment to Wise to fund your transaction. However, these charges are fairly minimal, especially when you send money via direct debit from your local bank account.

What Is a Mid-Market Exchange Rate?

The mid-market rate represents the midpoint between two currencies’ buy and sell prices. Wise always charges the mid-market exchange rate, whereas your bank will include a spread on the client’s rate to boost profits on an exchange transaction.

Fees aside, this is why you’ll save when you send international money transfers through Wise instead of, say, a bank-to-bank wire transfer. The mid-market rate is considered the most accurate rate of exchange between two currencies.

What Countries Can I Send Money To?

Wise has the ability to send money to most major countries and currencies. I counted no less than 70 countries on the Wise website. I’ve listed just a few of those below. I should note that there are restrictions on some currencies in how transfers can be sent and received. It’s important to read the instructions of the specific country you want to send funds to.

- Australia

- Brazil

- Canada

- China

- Columbia

- Denmark

- India

- Indonesia

- Israel

- Japan

- Mexico

- Norway

- Philippines

- South Africa

- South Korea

- Thailand

- Turkey

- United Arab Emirates

- United States

- Vietnam

How to Send Money with Wise

To illustrate how funds are sent using Wise, I’ll use the following example of converting CAD to USD. As you can see, it’s a fairly straightforward, 6-step process.

- Signup With Wise. Registration is free, all you’ll need is an email address, or you can use an existing Google or Facebook account. You can sign up through the Wise website or by using their mobile app.

- Set an amount that you wish to send. Wise will let you know upfront what the fee will be and when your transfer will arrive.

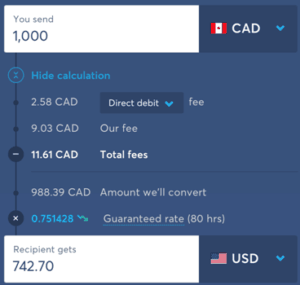

Here’s a snapshot of the calculated pricing of a CAD 1,000 transfer to USD. As you can see, the direct debit fee is only CAD 2.58, and Wise’s overall fee is CAD 11.61. When you consider the fact that you’re also saving money on the exchange rate (due to Wise using the mid-market rate), you’re going to save money with Wise vs. your bank.

- Provide your recipient’s bank details. Wise does provide the option of reaching out to your recipient to collect their information directly.

- Confirm your identity. Wise can verify your ID online, and in some cases, that may require you to provide a photo ID, such as a driver’s license or passport.

- Fund your transfer. You can do this through Apple Pay, direct debit (bank account), bill payment, wire transfer, or a debit/credit card. According to my calculations, you’ll incur the lowest fees via direct debit.

- Track your transfer. You’ve done everything you need to do. The rest is up to Wise, who will make sure your recipient gets their money. Wise allows you to track the progress of the transfer until it arrives at its destination.

I should point out, in my example above, the fee for sending payment via direct debit was $2.58. Here’s a list of the fee for the same transfer, using other payment methods. In this case, direct debit is by far the cheapest option.

- Debit card CAD 20.09

- Credit card CAD 29

- Domestic wire CAD 50

- Bill payment CAD 50

Wise Fees Explained

You may be wondering how Wise fees are structured compared to other companies or even your bank. When you send money, there are typically 3 components to a Wise transaction. Here’s how it breaks down:

Payment Fee

Wise charges a fee when you send money to your account for payment. Depending on the currency, you have up to 5 options: bank debit, debit card, credit card, wire transfer, or bill payment. As you can see in the CAD to USD example, I provided above. The bank debit method is the cheapest.

Transfer Fee

The transfer fee is expressed as a percentage of the amount of money being sent, but it’s below 1% in most cases.

Real Exchange Rate

The third and final component is the currency exchange. Wise will always convert your funds at the mid-market or real exchange rate. This is the rate without the 1-4% spread, or hidden fee, which your bank or broker always adds on. If you exchange funds regularly, this is where you can realize enormous savings through Wise.

The Wise Borderless Account

Formerly known as the Wise multi-currency account, the Wise Borderless account is a thing of beauty. If you are a freelancer or own a business with clients in several countries, Wise makes receiving payment in any number of foreign currencies a breeze.

Here’s how it works. You start by opening your borderless account through the Wise app. From there, you can hold accounts in up to 30 foreign currencies, opening each one with a single click. You will be assigned a personal account number in each currency.

Anyone can then transfer money into an account, and you won’t pay any fees. As I mentioned, you can hold money in your account in over 50 currencies and transfer currencies within seconds, at the real exchange rate (translation: far cheaper than your bank). Wise will charge a nominal fee for the exchange, displayed in an upfront, transparent fashion. Now, here’s where it gets interesting.

The Wise Debit Mastercard

Note: The Wise debit card is not yet available in Canada.

Depending on where you live, you can get a Wise debit card that allows you to spend the balance in your Wise Borderless account anywhere Mastercard is accepted. What’s cool is that if you don’t have enough funds in the local currency, Wise will automatically pull available funds from the currency with the lowest exchange fee (providing you have funds available).

Features of the Wise Borderless Account:

- Hold up to 30 foreign currencies in your account

- No fees to receive payments into your account

- Free ATM withdrawals up to £200 monthly

- Nominal fee charged when you exchange between currencies (0.35-2%)

- Convert funds between currencies instantly, at the real exchange rate

At this time, the Wise debit card is not available to Canadian residents, although you can still qualify for a multi-currency borderless account. As per the Wise website, the debit card is currently available to residents of Australia, the U.K., the US, New Zealand, Singapore, Japan, Switzerland, and the EEA.

Here’s hoping that the service extends to Canada in the near future, as it would definitely add a level of convenience for Wise’s Canadian account holders. Feel free to join the Wise debit card waitlist, and they’ll let you know when the product is available in Canada.

Is Wise Safe?

Anytime you’re dealing with a new company, especially one that will be transferring your money, you want to know that your funds, along with your personal information, are safe. You can rest assured that this is the case with Wise. The money service business is registered with the financial regulating agencies in all of the major countries in which they do business.

For example, in Canada, Wise is registered with FINTRAC, which helps detect, prevent and deter prevention and money laundering and the financing of terrorist activities. All major financial institutions in Canada are required to report transactional information to FINTRAC.

Likewise, in the U.S., where Wise belongs to the Financial Crimes Enforcement Network (FinCEN). Not only that but Wise deposits are held in financial institutions that are protected by the Federal Deposit Insurance Corporation (FDIC).

For account login purposes, Wise uses two-factor authentication to protect your accounts and personal information. This is similar to the level of online security you would experience with your primary bank and ensures that only you can access your Wise account.

As with most financial institutions, Wise has a dedicated fraud team that is working constantly to keep your money safe from fraudsters.

Wise Comparison vs. PayPal / WorldRemit / RBC

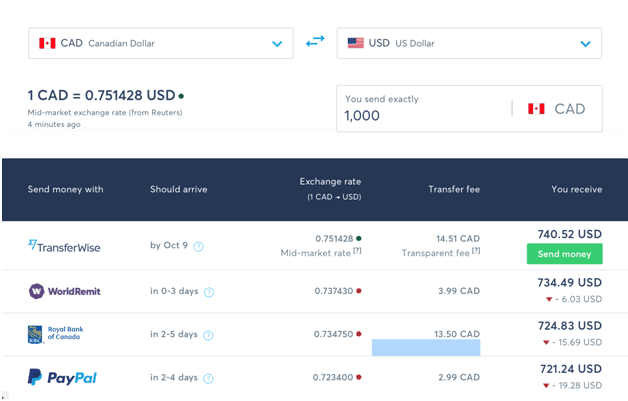

For a quick look at how Wise stacks up against other money transfer companies, I took a screenshot of a helpful comparison tool directly from the Wise website. This allows you to get a real-time look at the exchange rates and fees for a Wise transaction and compare it with the same transaction from a few key competitors: Royal Bank, PayPal, and WorldRemit.

You’ll notice in this example that Wise is the only company offering the mid-market exchange rate. So, while their fee is actually the highest on the list, you would come out between $6-19 ahead with Wise vs. its three competitors. Keeping in mind, of course, that this comparison was made using Wise and not a 3rd party app.

Wise Customer Support

If you’re looking for support through Wise, I recommend that you start at their Help Centre, located on their website. Here they have a tonne of articles designed to answer just about any question you might have.

If you’ve gone through the Wise FAQs and still have questions, Wise makes it easy for customers to reach them anytime, via email or phone. In Canada, telephone contact hours are between Monday-Friday, 9 AM-7 PM EST. Or, you can send them your question via email right on the website.

Summary of Wise Benefits

- transfer money at the real exchange rate

- Low, transparent fees

- Send money to over 70 countries

- high transfer limits vs. competition

- No need to visit your local bank to transfer funds

- Convert your money in seconds

- Link your account to Amazon, Paypal

Are there Drawbacks to Wise?

While our overall review is positive, no product or service is without its drawbacks. The first one I can think of is the lack of a debit card for Canadian account holders. While you could argue that no other comparable service is offering debit cards, residents in other countries are able to maximize the convenience of a Wise debit card, and Canadians cannot. Hopefully, this will be resolved in the near future.

Also, it’s important to remember that Wise is not a bank account. Your funds don’t earn interest, and your balance is not guaranteed by an entity like CMHC, for example. Wise does what they can to protect your security, but there are no guarantees. They do make this point clear on their website.

Wise operates as a bank-to-bank transfer service, which means that they don’t offer physical locations where the recipient can pick up cash directly, as they could via Western Union, for example.

Wise Review: Final Thoughts

There you have it, our Wise Review, updated for 2021. Like most financial products and services, Wise isn’t for everyone. For example, if you only perform the occasional foreign exchange transaction, then it’s likely not worth the effort to save a couple of bucks here and there.

However, if you buy and sell foreign currency with any regularity, either personally or for business reasons, and you’re currently doing so through your primary bank, you really should consider moving that part of your business to a company like Wise. You’re simply leaving too much money on the table otherwise.

Comments

The debit Mastercard is not available in Canada yet.

Great review, Tom. I’m temporarily living in the U.K. — so all my income is in Canada and most of my expenses are in the U.K. I’ve been using Transferwise for 5 months and it is better than my bank’s FX transfer service in every way: cost, reliability, safety, peace-of-mind, transparency, and customer service.

I had been using Visa Direct service through TD Canada Trust and the experience was horrible, horrible, HORRIBLE! Visa Direct’s daily maximum was $2,500 ($9,500 @ Transferwise), it was way more expensive, but Visa Direct was totally unreliable. I once made the mistake of sending two $2,500 transfers (both going to my U.K. bank account) with Visa Direct two days in a row. One transfer went through fine; the other failed & I was missing $2,500 for 10 days! Eventually, Visa ‘solved’ the problem by reversing the failed transaction (returning the missing $2,500), but they also reversed the successful transfer & removed the money that did actually get to my U.K. account, & put it back into my TD account. So … no money was transferred! Frankly, Visa should remove their service from the market & TD should be ashamed of continuing to offer it. I had other problems with Visa Direct before switching to Transferwise.

Transferwise is excellent. They do what they say they do and the money shows up at the other end right on time. And I’ve saved considerably in fees.

Do you know how this compares to Knightsbridge?

A more interesting and useful comparison might be Wise vs. xe.com, ofx.com , or Knightsbridge.