Petsecure Review: Is it Worth It?

Owning a pet can be expensive, especially if they have an accident or illness. With the high cost of veterinary care, more Canadians are purchasing pet insurance to avoid financially-crippling vet bills. In this Petsecure review, we’re covering one of Canada’s largest pet insurance companies. I’ll explain how their coverage works, including their deductibles, share pros and cons, and some Petsecure alternatives to help you decide if Petsecure is worth considering.

What Is Pet Insurance?

Pet insurance is designed to cover pet owners from a financial setback caused by an injury or unexpected illness to their pets, usually dogs or cats. As with any insurance plan, the insured pays a monthly premium for coverage and, if a claim is made, a deductible.

What Is Petsecure?

Winnipeg-based Petsecure is one of Canada’s largest pet insurance companies. The Petline Insurance Company underwrites its policies. Unlike some pet insurers, Petsecure’s sole focus is on pet health insurance, and they don’t sell other types of coverage.

How Petsecure Insurance Works

Purchasing pet insurance and making a claim is a four-step process with Petsecure. Here’s what you need to do:

- Review the Petsecure Insurance plans and choose the one that’s best suited for your needs and budget.

- After you sign up, you must adhere to the following waiting periods before you become eligible for coverage: Accidents – 48 Hours, Illness – 14 Days, Dental coverage – 6 months.

- Pay your vet bill and have an authorized employee from the vet clinic assist you in filling out a claim form.

- Petsecure will approve your claim and reimburse you via cheque or direct deposit.

Petsecure Plans

Petsecure offers separate insurance policies for dogs and cats, with several plans available for each. Here’s a closer look at the different plans Petsecure offers.

Dog Insurance Plans

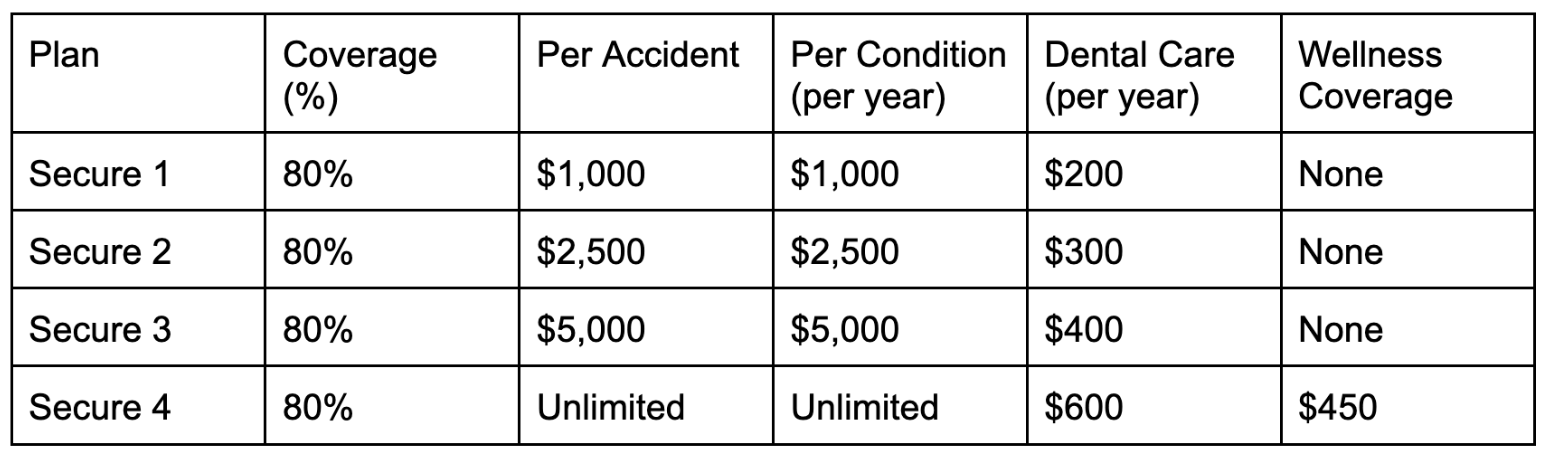

Petsecure offers four plans to suit your dog’s needs and budget. With comprehensive coverage, these plans ensure your furry friend can receive the necessary veterinary services. Here’s a brief overview of the dog insurance plans:

What’s Included:

Generally, Petsecure’s dog insurance plans cover the following injuries and illnesses, up to the limits noted on the chart above:

- Up to 80% of vet bills, including exam fees and taxes

- Accidents and illnesses

- Diagnostics

- X-rays

- Emergency care and hospitalization

- Surgeries

- Medications

- Dental coverage (annual cleanings, problems with gums and teeth)

- Boarding/Kennel fees

- Lost pet advertising

- Holiday cancellation

- Cremation/burial costs

- Alternative treatments (acupuncture or massage)

- Behavioural therapy

- Medical devices

- Wellness coverage (Secure 4 only)

What’s Not Included:

- Pre-existing conditions

- Optional treatments

- Food and special diets

- Spay or neuter surgery

- Pregnancy and whelping

- Alternative medications

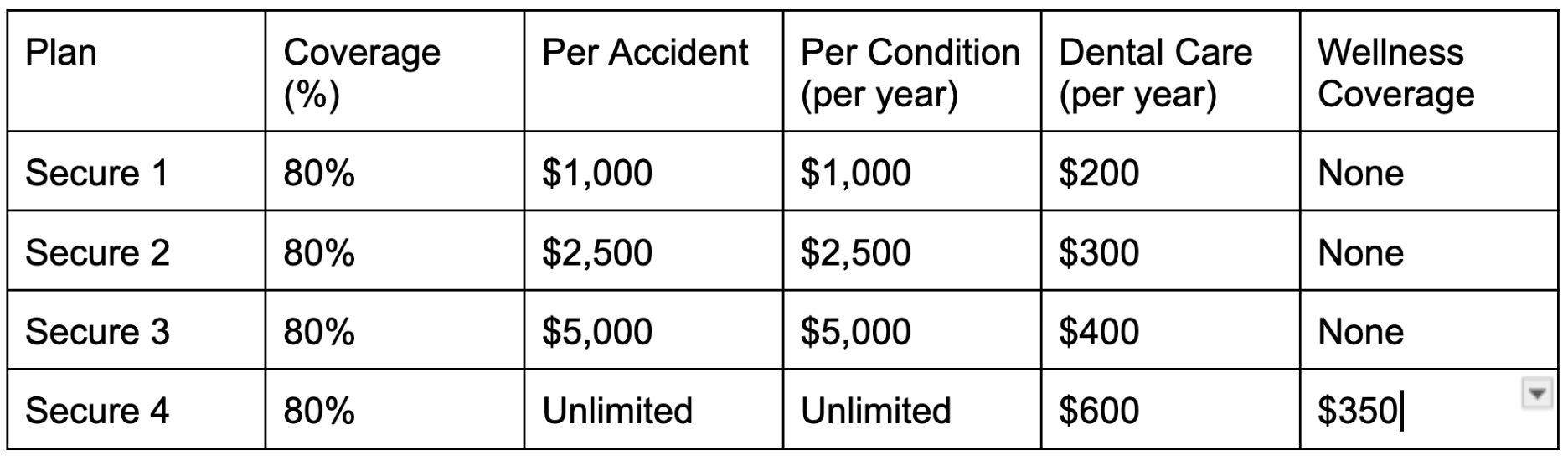

Cat Insurance Plans

Petsecure’s cat insurance plans are nearly identical to its dog insurance plans, with the exception of the wellness coverage amount on the Secure 4 plan ($350 vs. $450).

What’s Included:

Petsecure’s cat insurance plans have nearly identical coverage inclusions and exclusions as its dog insurance plans:

- Up to 80% of vet bills, including exam fees and taxes

- Accidents and illnesses

- Diagnostics

- X-rays

- Emergency care and hospitalization

- Surgeries

- Medications

- Dental coverage (annual cleanings, problems with gums and teeth)

- Boarding/Kennel fees

- Lost pet advertising

- Holiday cancellation

- Cremation/burial costs

- Alternative treatments (acupuncture or massage)

- Behavioural therapy

- Medical devices

- Wellness coverage (Secure 4 only)

What’s Not Included:

- Pre-existing conditions

- Optional treatments

- Food and special diets

- Spay or neuter surgery

- Pregnancy and whelping

- Alternative medications

Petsecure Pricing

Petsecure doesn’t publish pet insurance premiums on its website because coverage costs vary based on several factors, including your pet’s age, breed, location, and gender.

That said, you can obtain a free quote on the website. Enter your pet’s details, and Petsecure will email you pricing. You can also contact Petsecure’s Call Center at 1-800-268-1169 during business hours.

Petsecure Deductibles

Petsecure gives you the option to choose from two deductibles. The deductible amounts vary, depending on the Secure Plan you choose, and the age of your dog or cat.

For example, if your dog is up to 5 years old, you can choose a $100 or $300 deductible on Secure 1, 2, or 3, and $250 or $400 on Secure 4.

Generally, the older your pet, the higher the deductible. For example, if you have a dog that’s 10 years of age or older, the deductible increases to either $500 or $700.

Petsecure Alternatives

Petsecure isn’t the only pet insurance provider in Canada. Before signing up, I recommend checking out the following Petsecure alternatives to ensure you get the best pet protection.

Trupanion

Trupanion is another well-known pet insurer in Canada. They offer comprehensive coverage, including accident and illness protection and customizable deductibles. What sets Trupanion apart is their direct-pay option, which allows them to pay your veterinarian directly instead of having you pay upfront and wait for reimbursement. They also cover 90% coverage instead of the 80% Petsecure offers. This can be especially helpful for large, unexpected expenses; however, comparing premiums between providers is important.

Pets Plus Us

Pets Plus Us offers a variety of coverage options to suit your needs and budget. They provide accident-only, accident and illness, and wellness add-on coverage. One unique feature is their Blue Ribbon Benefits program, which offers additional services such as a pet poisoning helpline, bereavement counseling, and travel assistance.

Petsecure Pros and Cons

Petsecure has several coverage options and some potential drawbacks. Here are a list of Petsecure pros and cons:

Pros:

- Choice of 4 plans for both dogs and cats

- Unlimited coverage available

- Available Canada-wide

- Multiple deductible options

Cons:

- Poor Trustpilot customer score

- No direct pay option

The Bottom Line on Petsecure

Petsecure is a longstanding pet insurance company. They offer flexible coverage, solid dental care available on all plans, and the option to purchase wellness coverage. You also have a choice of deductibles. Unfortunately, there is no direct pay option. If you make a claim, you must pay the full price upfront and be reimbursed by Petsecure after the fact.

If direct pay is important to you, I recommend checking out other providers, such as Trupanion. Remember that you may pay more for premium coverage options, so look closely at each company’s premiums to ensure you’re getting the best value for your dollar.

FAQs

How does Petsecure compare to Trupanion?

Petsecure offers four levels of coverage, catering to different needs and budgets. On the other hand, Trupanion provides a more straightforward, customizable plan with 90% coverage and no payout limits. Both companies cover accidents, illnesses, and hereditary conditions, but Petsecure may include dental coverage, whereas Trupanion does not. To decide which one suits you best, evaluate your pet’s needs and thoroughly research each company’s offerings.

What are the common issues with the Petsecure claims process?

While the sample size is very small (6 reviews at the time of writing), Petsecure has a less than favourable rating of 2.3 stars on Trustpilot. Common problems include processing delays, denied claims due to pre-existing conditions, and confusion around coverage limitations. To minimize these issues, it’s essential to read and understand your policy thoroughly, keep all documentation related to your pet’s health, and communicate with Petsecure representatives when needed.

Does Petsecure cover dental?

Yes. Coverage is included for routine dental procedures on all Petsecure pet insurance plans.

Comments

At age 10 our female Yellow Labrador developed diabetes, we still have her, but it’s costing us around $7,000 a year to keep her alive. She’s just turned 12. We didn’t have pet insurance, and obviously can’t get it now. Oh well!