Is It Worth Raiding Your RRSPs for the Home Buyers’ Plan?

For prospective first-time home buyers looking to break into Canada’s housing markets, every bit of help is warranted, especially in the pricey Greater Toronto and Vancouver real estate markets; price growth in these urban centres has been so rampant in recent years that it has prompted intervention from multiple levels of government, as home values have outpaced both incomes and the ability of buyers to save their down payments.

However, there are a few measures available to help these buyers gain a foothold, and one of the most established in the first-timer lexicon is the Home Buyers’ Plan (HBP). First offered in 1992, this program allows home buyers to dip into their Registered Retirement Savings Plan (RRSP) funds without any tax consequences, to put towards a home purchase. An individual can withdraw up to $35,000 from their savings, or up to a combined $70,000 for two first-timers buying together.

Who Can Use the HBP?

To be considered a first-time buyer, individuals cannot have owned a home, or have dwelled in a home owned by their spouse, within the consecutive four years prior to this home’s purchase. Buyers must also have a signed Agreement of Purchase and Sale in hand to purchase or build a home before they can apply for the HBP, and they must dwell in it as a principal residence within a year of its purchase or completion. As well, the funds must be sheltered within the RRSP for 90 days before they can be withdrawn for the HBP.

However, these funds don’t come scot-free; home buyers are essentially borrowing from themselves, and they must pay their RRSPs back in installments over a 15-year timeframe. Failure to make a payment in any given year will earmark that portion of funds as income, which will be taxed at the buyers’ full tax rate.

Is Using the HBP Always a Good Idea?

The HBP has not been without its critics: for example, some financial experts have argued that given their restrictions and repayment criteria, that the much more flexible Tax-Free Savings Account could make more sense for buyers, especially those in lower earning brackets, or those who don’t receive the option of RRSP matching from their employer. In fact, Statistics Canada reports that the demographic of Canadians most likely to use an RRSP doesn’t align with that of first-time home buyers; while 35% of all Canadians contribute to an RRSP, participation is highest among households with a major income earner bringing in $80,000 – $99,999, and between the ages of 35 – 54 at 50.8%. In contrast, only 20.1% of lower-earning Canadians use RRSPs.

Then, there are the potential opportunity costs for those who plunder their retirement savings – removing the funds deprives them of the chance to earn a tax-sheltered rate of return, which would compound over time. To get an idea of how much retirement money would be lost, let’s assume a home buyer pulls the maximum $35,000 from their RRSP where it would have earned an annual rate of return of 5%. If that $35,000 had been left alone in the RRSP, it would have totalled $72,754 by the fifteenth year – earnings of $37,754.

However, under the requirements of the HBP, the 15-year investment horizon would kick off with just $2,333 in the account – one –fifteenth of the withdrawn amount. Assuming the home buyer never misses an annual repayment, the RRSP account would total $50,332 after 15 years – a difference of $22,422.

Of course, one could argue that in Canada’s hottest real estate markets, home equity has increased at a much brisker pace. Take, for example, how the average price for homes for sale in Toronto have evolved in the past 15 years: in January 2005, the average abode could be purchased for $323,141, according to the Toronto Regional Real Estate Board. That’s compared to the $ 839,363 it would take in January 2020 – an increase of 159.7%. Assuming the home has been used as a principal residence, those capital gains could also be realized tax-free when the home is sold.

How Far Would $35,000 Go in the Housing Market, Anyway?

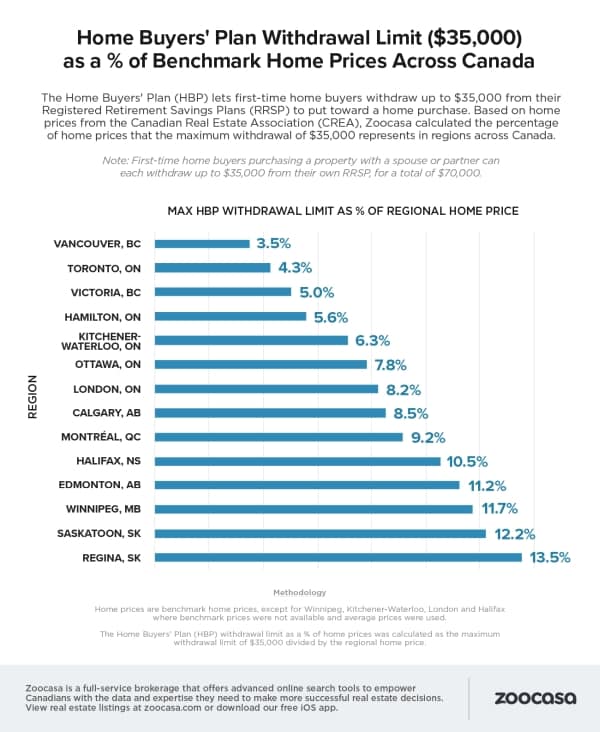

Finally, the HBP has come under scrutiny for just not having the teeth to make a mark in the nation’s priciest housing markets. Despite being upped to $35,000 from the previous $25,000 in last year’s federal budget, that can range from being a hefty down payment to a drop in the bucket, depending on where buyers are looking to purchase.

For example, as per the infographic below, $35,000 would account for just 3.5% of a home purchase in Vancouver, and 4.3% of the benchmark price for Toronto real estate – less than the minimum 5 – 7.5% down payment required to purchase a home. However, in Canada’s most affordable markets, such as in Regina, a buyer could fund up to 13.5% of their purchase with their HBP funds.

Should You Use the HBP?

As with most financial strategies, whether or not the HBP is the savviest method to accumulate a down payment depends largely on the home buyer’s individual circumstances. For those who have diligently saved their RRSP funds and are buying into a market where real estate equity have a strong track record of growth, it can certainly be an effective way to get into the market faster, and start benefiting from its upward trajectory. However, it’s important to remember that for many, there’s a big difference between a real estate investment and the family home, and that relying mainly on the housing market to fund retirement may not be the best course of action for all. As always, it’s a great idea to consult a financial advisor when determining your down payment, and retirement, strategy.