XEQT Review: An Asset Allocation ETF for Long-Term Investors

If you want to invest in equities, you have a few options. You can attempt to build a diversified portfolio of individual stocks, but that would require buying between 30-50 stocks across several global markets. Unless you have significant assets and a lot of time on your hands, it’s not an efficient way to invest in the markets.

Another option is to handpick a few broad-index ETFs. For example, you could buy a Canadian S&P/TSX ETF, a U.S. S&P 500 ETF, and one or two international ETFs. Your fees would be very low, but you would be responsible for picking the right mix of funds and rebalancing.

Instead, you could buy one asset allocation ETF, like XEQT. In this XEQT review, I’ll explain how the fund works, its pros and cons, and let you know why it might be right for your portfolio.

What Is an Asset Allocation ETF?

An asset allocation ETF, often called an all-in-one ETF, comprises several index ETFs and aims to provide investors with a complete portfolio in a single ETF, with fixed income and equity investments, along with global exposure.

The beauty of an asset allocation ETF is that it takes the guesswork out of investing. You don’t have to stress about picking individual stocks or bonds because the ETF does it for you. It can also be cost-effective, making it a smart choice for investors of all experience levels.

About XEQT

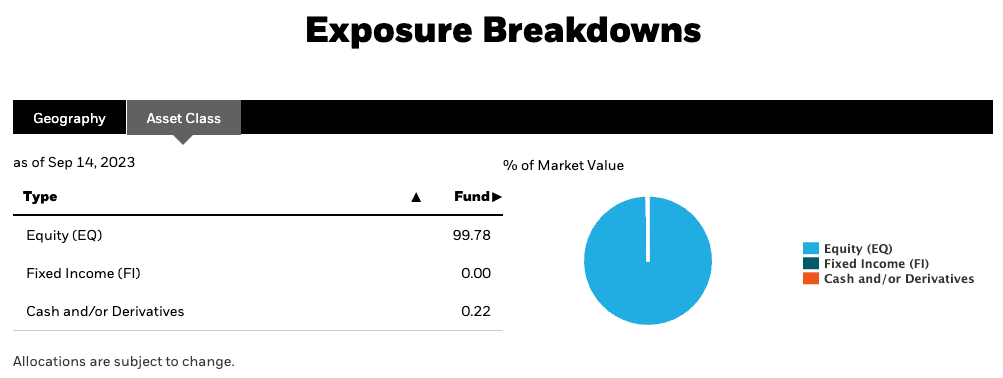

iShares Core Equity ETF Portfolio (XEQT) is an asset allocation ETF from iShares, one of the world’s largest ETF providers. The fund focuses on the equity asset class and holds nearly 100% stocks, though it may have small amounts of cash or cash equivalents at any time.

XEQT is the most aggressive of the iShares all-in-one ETFs, with a long-term strategic equity allocation of 100%. The fund is designed for investors seeking long-term capital growth through equity securities.

XEQT At-A-Glance

Here are some quick facts about XEQT as of Sept 2023:

- Date of Inception: August 7, 2019

- Net assets: $1.97 billion

- Management fee: 0.18%

- Management Expense Ratio (MER): 0.20%

- Number of holdings (funds): 4

- Underlying holdings: 9,328

- Distribution yield: 2.96%

- Risk Level: Medium

XEQT Holdings

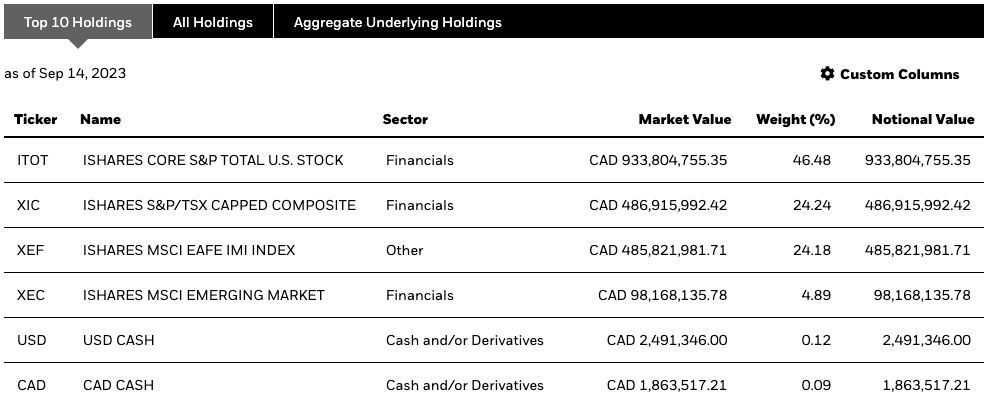

XEQT is made up of the following four individual iShares ETFs:

- iShares Core S&P Total U.S. Stock (ITOT) is a broad-based index ETF that gives investors access to the total U.S. stock market in a single fund. The fund has a minuscule MER of 0.03%.

- iShares S&P/TSX Capped Composite (XIC) aims to replicate the performance of the entire Canadian stock market (TSX). It currently consists of 227 holdings and has an MER of 0.06%.

- iShares MSCI EAFE IMI Index (XEF) offers international diversification with exposure to over 1500 stocks in Europe, Asia, and Australia. It’s meant to be a long-term holding with an MER OF 0.22%.

- iShares MSCI Emerging Market (XEC) holds more than 1,500 stocks from emerging markets worldwide, including China (26.40%), India (16.94%), Taiwan (15.83%), and South Korea (12.78%). The fund’s MER is 0.28%.

As you can see, XEQT investors achieve global diversification in a single portfolio, with holdings that span the U.S. (47%), Canadian (24%), international(24%), and emerging markets (5%).

XEQT Top 10 Individual Stock Holdings

XEQT’s top holdings, along with their respective weightings, are as follows:

- Apple Inc (2.74%)

- Microsoft Corporation (2.66%)

- Royal Bank of Canada. (1.41%)

- Amazon.com Inc (1.36%)

- Toronto Dominion Bank (1.26%)

- NVIDIA (1.19%)

- Alphabet Inc (Class A) (0.87%)

- Shopify Subordinate Voting Inc CLA (0.84%)

- Canadian Pacific Kansas City Limited (0.83%)

- Enbridge Inc. (0.79%)

XEQT has over 9,000 underlying equity holdings. This broad diversification helps minimize risk and maximize gains in the long run. With such a low MER (0.20%), XEQT offers an affordable way to build an all-equity portfolio.

XEQT Fees

XEQT has an MER of 0.20%, much lower than any mutual fund portfolio but higher than many broad-based index ETFs. For example, ITOT, which is one of the ETFs held by XEQT, provides exposure to the total U.S. stock market and has an MER of only 0.03%.

The reason that asset allocation ETFs are slightly more expensive is that they provide a complete portfolio solution. The portfolio manager combines several ETFs to ensure global diversification while rebalancing the portfolio as needed.

You could save money on fees by managing your own handpicked portfolio of equity ETFs, but you would have to spend a lot of time rebalancing and ensuring that your portfolio is properly diversified.

XEQT Pros and Cons

Asset allocation ETFs like XEQT offer several benefits to investors. But there are also drawbacks. Here is my list of pros and cons:

Pros

- Low-cost investment solution

- Instant global diversification

- Professionally-managed portfolio

- Highly liquid; traded in real-time on the stock market

- Automatic rebalancing

- Can purchase commission-free with some online brokers (i.e., Questrade, Wealthsimple Trade)

Cons

- Not suitable for conservative investors (100% equity holdings)

- Not the best option for dividend income investors

- Higher fees than individual stocks and ETFs

XEQT vs. VEQT

One of the closest alternatives to XEQT is Vanguard’s All-Equity ETF Portfolio, or VEQT. Like XEQT, VEQT is a 100% equity asset allocation ETF.

While the investment objectives of the two funds are identical, there are a few minor differences between them. XEQT has a slightly lower MER (0.20% vs. 0.24%). When it comes to net assets, VEQT is the larger of the two funds, with $2.94 vs. $1.97 billion under management. VEQT also holds more stocks (13,640 vs. 9,328), though XEQT has a slightly higher exposure to the U.S. market.

All in all, the differences are negligible, and you can go either way. I personally hold VEQT in my RRSP portfolio, but choosing between the two really is a coin flip. For example, the 0.04% difference in MER is approximately $40 annually on a $100,000 portfolio.

The Bottom Line on XEQT

The most significant advantage of any all-in-one ETF, including XEQT, is its simplicity. If you’re looking for a 100% equity investment that offers global diversification and automatic rebalancing, XEQT may fit the bill.

Remember to evaluate your risk tolerance and financial goals before making any investment decisions. Equity investments should always be approached with a long-term perspective, and XEQT is no exception.

FAQs

How does XEQT’s MER compare to other ETFs?

At the time of this writing, XEQT’s MER is 0.20%, which is slightly lower than VEQT, which is a comparable ETF from Vanguard.

What is the performance difference between XEQT and VFV?

XEQT has a 3-year average return of 9.16% as of August 31, 2023, while Vanguard’s VFV has returned 11.41% (market price) over the same period. It’s important to note that XEQT and VFV have different investment objectives and holdings. XEQT is an all-equity ETF, focusing on a diversified stock portfolio, while VFV aims to replicate the performance of the S&P 500 Index. Due to these differences in objectives and holdings, their performances will vary.

Are there any risks associated with investing in XEQT?

As with any stock market investment, there are risks involved with investing in XEQT. Since XEQT is an all-equity ETF, it fully invests in stocks, exposing it to market volatility. During periods of market fluctuations, your investment may see significant ups and downs in value.

Additionally, XEQT invests in a number of different sectors and geographies, which may expose you to certain risks like geopolitical issues or economic downturns in specific industries or regions. It’s crucial to analyze these risks in relation to your personal investment goals and risk tolerance.