Make financial resolutions you can actually keep

We’ve all done it. Made resolutions to completely reform aspects of our lives. But if the resolutions aren’t realistic, we can quickly become discouraged, and end up back where we started.

This post will contrast extreme financial resolutions with more realistic options.

Extreme resolution

I will keep track of every dollar I spend.

Realistic option

This is an important step in taking control of your finances if you actually find a system that will work for you. Research tracking options. Do you prefer tracking by paper? Try a budgeting binder. If you would rather track your spending electronically, use an online tool.

![]()

Extreme resolution

I will become a couponing champion.

Realistic option

If you have not been a couponer before, it is better to begin slowly. Order coupons from three companies that mail them to you, and organize yourself to use those coupons before they expire. Then check Mrsjanuary.com for tips about building up your coupon collection gradually.

Extreme resolution

I will price match every item on my shopping list.

Realistic option

Begin to price match by focusing on front-page deals and produce. Or consider price matching from 2 or 3 stores to get you started. This will save you a significant amount of money and encourage you to expand your price matching once you get the hang of it.

Extreme resolution

I will cut my grocery bill in half this year.

Realistic option

In order to consistently reduce your grocery bill, you first need to know how much you are spending on average. Track your grocery spending for a few months and try to first reduce it by 10% then 20% and so on. Be proud of small steps that will make a difference over time.

Extreme resolution

I will create a floor-to-rafter stockpile by the end of January.

Realistic option

Set aside a reasonable amount each month to gradually build your stockpile. Even if it is $20/month you will begin to save money by shopping from your stockpile.

Extreme resolution

I will stop eating out at restaurants.

Realistic option

If eating out has been something you have enjoyed quite regularly, it may not be realistic to cut this out completely. Rather, set aside a reduced amount as part of an entertainment budget and be diligent to track your spending.

Extreme resolution

I will plan my menus every week.

Realistic option

If this has not been your regular routine, consider beginning slowly. Perhaps consistently plan 3 or 4 meals each week, and supplement these with other easy favorites. Download menu planners to simplify this process and repeat weekly plans to get you started. Your decreased stress will inspire you to build up your menu plan further.

Extreme resolution

I will not have lunch-making chaos in the mornings.

Realistic option

Again, take steps towards this ideal. Read our post on healthy lunch ideas and write down a few to try this week. Make sure your kitchen is organized for lunch making success, and lunches will be much easier to prepare.

Extreme resolution

I will spend less on utilities this year.

Realistic option

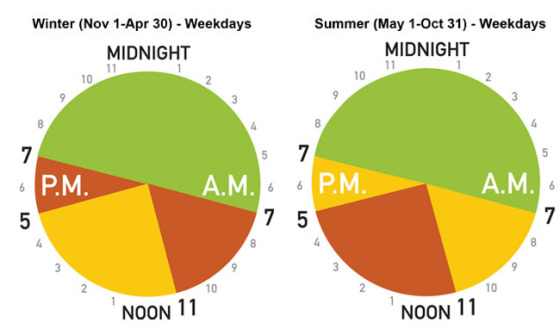

You can significantly reduce utility bills, by changing daily habits. Focus on small changes at a time. Commit to doing laundry and running the dishwasher during off-peak time. Off-peak costs almost 50% less than peak time, so this will make a difference to utility bills, which will encourage you to try other ideas.

Extreme resolution

I will put money into savings this year.

Realistic option

While this is a worthwhile pursuit, it is not a measurable goal yet. Set a specific goal of how much you will save each month. $20? $50? $100? Set up a no-fee online account to make this convenient. Find someone to hold you accountable by checking in with you at the end of every month. Reward yourself for meeting your goal – but not by spending what you just saved.

Small changes in financial habits are more likely to be sustainable. Rather than hoping for grand changes to happen quickly, be disciplined in changing one or two areas of your finances.

What financial resolutions are you making this year?